Get richer every month

Course

Get immediate access to The Surplus Method, covering everything from the money mindset to debt, saving, investing in ETFs, buying individual stocks, building a dividend portfolio, and planning for financial independence and retirement. Get free tickets to attend our live Financial Fêtes with guest experts, either online or in person.

Community

Connect with like-minded women who are committed to ending the year with their richest bank balance yet, investing their first $100,000 and working towards the end goal of achieving financial independence. Deepen your connections by participating in Challenges, attending in-person Meetups, and joining an intimate Accountability Circle.

Coaching

Join us for our bi-weekly Money Promenade, a hands-on money hour where we collaboratively tackle your budgeting, financial goals, investments, and any questions you may have. Each month, you'll also receive one free Money Audit with personalized feedback. Feel free to ask me as many questions as you like through our Private Messaging!

IMAGINE BEING ABLE TO SAY:

"This is the most commas and zeros my bank accounts have ever seen"

and because of that, you're able to:

| ♦︎ |

Pay off all consumer debt. |

| ♦︎ |

Stock your emergency fund. |

| ♦︎ |

Max registered accounts. |

| ♦︎ |

Purchase your first home. |

| ♦︎ |

Splurge on a big purchase. |

| ♦︎ |

Book the dream vacation. |

BUT RIGHT NOW, YOU'RE STUCK IN A SEASON

Which Surplus Season resonates with you?

Are you The Debutante?

You’re earning a good income, but if your next paycheck is delayed by one month, you will be late on your bills, and this keeps you up at night.

| ▸ |

You keep telling yourself, “I must be terrible with money,” because your bank account never goes beyond one month of expenses. |

| ▸ |

Once one unplanned expense comes up, your account goes into overdraft, and you get hit with NSF fees. |

| ▸ |

You haven’t looked at your last credit card statement because you know that you did some damage on that last Costco haul. |

You’ve buried your head in the sand because you’re not ready to face the hard truth—you’re spending more than you're earning.

Or are you The Baroness?

You typically have money left over after all your bills and essentials have been paid, but at the end of every month, you always wonder, "Where did my money go?"

| ▸ |

You think budgets are too limiting, so you never stick to yours. |

| ▸ |

You start a savings account, but the moment you see that bright yellow sale sign, there goes your savings. |

| ▸ |

You can’t count the number of times you’ve said, “This year, I’ll be debt-free,” only to end the year with a higher balance than you started with. |

You feel so much shame because you make good income but have nothing to show for it.

Are you The Viscountess?

You’re finally in control of your spending. You’ve cleared debt, and your savings can cover major emergencies without sending you into debt.

| ▸ |

But you’ve parked the cash that should be invested into a savings account earning little to no interest because you’ve convinced yourself that investing is too hard and you don’t have time to learn. |

| ▸ |

You know you should be investing, but the farthest you’ve gotten is opening a Wealthsimple account. |

| ▸ |

You keep getting ETF and stock recommendations from social media, and your portfolio looks like a poor-performing hedge fund, and you want a better structure. |

You’re tired of doing nothing with your money, but you feel overwhelmed by the investment options out there and don’t know where to start.

Or perhaps you’re The Duchess?

You’re confident with your finances, have no debt, built solid savings, and even started investing—but you want more.

| ▸ |

A life where you no longer have to work for money. |

| ▸ |

You want your kids to go to university debt-free and escape the struggles you faced with student loans because you set them up for success. |

| ▸ |

You want to give generously to your community and retire your parents. |

But you don’t see how that’s possible with all the financial responsibilities you’re currently juggling.

REGARDLESS OF YOUR SURPLUS SEASOn

The Surplus Stack Society helps you achieve your richest year yet by putting your surplus to work

We help you uncover a 30% surplus in your disposable income, follow a consistent money routine that allocates that surplus to paying down debt, building savings, and growing investments each month, and track your progress with a 12-month Richest Year Roadmap so you finish the year with more zeros and commas in your bank accounts than ever before.

I'M READY FOR ONE MORE ZEROHere’s how we help you have your richest year yet

Uncover Your 30% Surplus

Use the Surplus Stack System to see exactly how much of your income is left after bills and essentials, then tighten money leaks until you reach a consistent 30% surplus.

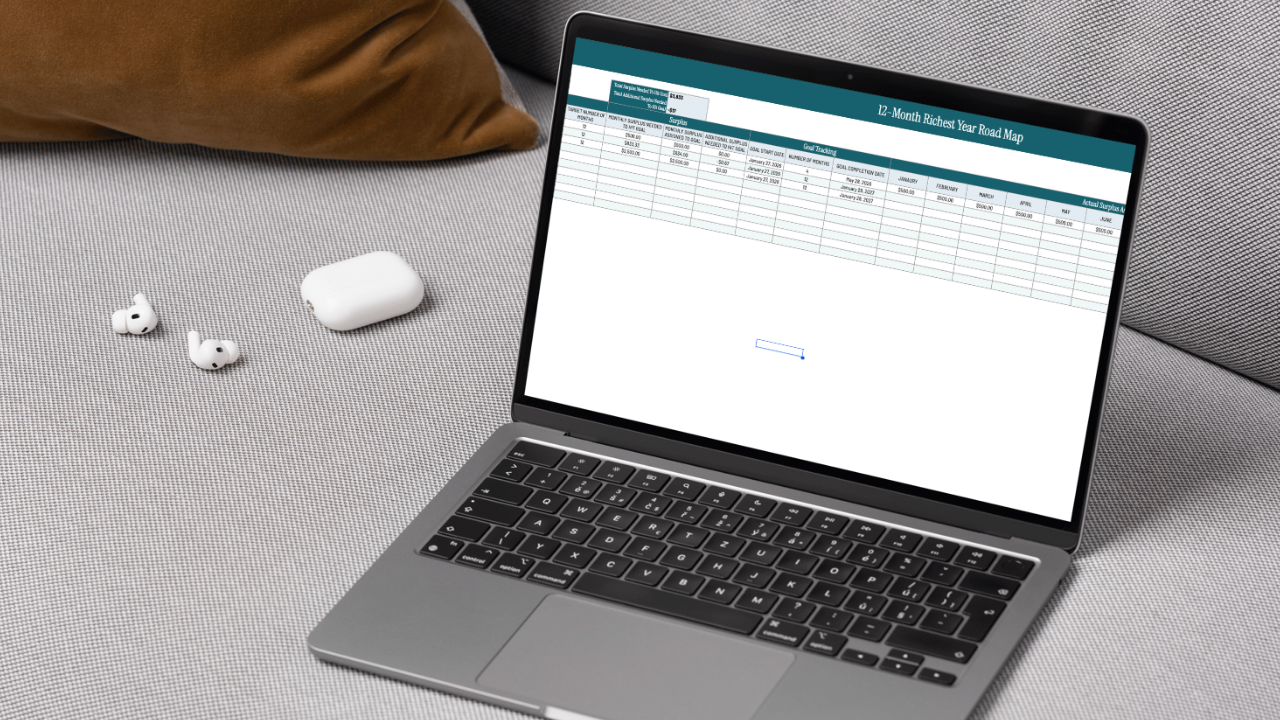

Build your Richest Year Roadmap

Use that surplus to map a 12-month plan that shows how much debt you can pay off and how much you can save and invest, month by month.

Create your 90 Day Action Plan

Break the 12-month roadmap into a focused 90-day checklist with three wealth-building actions you will prioritize to hit one clear goal. When the 90 days are complete, review, choose the next goal, and repeat.

Here is what your richest year roadmap would look like if you take home $2,500 bi-weekly and have a 30% surplus of $750/paycheque

and the best part is that you will be $19,500 richer

YOU'RE PROBABLY WONDERING HOW ALL OF THIS WOULD BE POSSIBLE IN JUST ONE YEAR

Well, let's cut to the chase, if you want to achieve any major money goal

You need to free up at least 30% of your disposable income

Whether your goal is to pay off debt, buy a home, build an emergency fund, save for a dream vacation, or become work-optional, it starts with having a consistent surplus. That means keeping at least 30% of your income after covering your bills and essentials. Without a 30% surplus, you're stuck in survival mode and living paycheque to paycheque.

GET ME OUT OF SURVIVAL MODE →I CAN ALREADY HEAR YOU SAY: ALL OF THIS SOUNDS GREAT

But why does it feel so hard?

You need a money system and routine that tells your money where to go on autopilot

You’re working hard, earning more, but your bank account doesn’t reflect it. Where does it all go? It's because you lack a money system and the consistency to follow through on your goals.

The only way to get ahead financially is to have a surplus

Why is it that you’re making the most money you’ve ever made, yet you still feel behind financially? It's because you spend every dollar you earn.

You’re one milestone away from your richest year yet

Why does financial freedom feel like a far-off dream, instead of a reality you can build right now? You need a clear road map to show you how to get there and a supportive community that ensures you reach your goals.

I have good news for you:

The Surplus Stack Society is where all your money frustrations end.

Inside the Surplus Stack Society, we give you a step-by-step roadmap that will help you keep more of what you earn so you can knock off all your money goals. Inside you will:

Discover how to free up 30% of your income without sacrificing what you love.

Create a 12-month roadmap that shows you when and how to achieve your financial goals.

Shift your mindset, habits, and systems to move from stress to living in surplus.

Learn how to pay off debt, build savings, and grow your investments.

Build a money system that makes managing your money effortless and enjoyable.

Join a supportive community of women navigating the same financial milestones.

I've been where you are now.

earning a high income but my accounts kept going into overdraft every other month, avoiding my credit card statements, sending money to my savings but moving it back to my chequing ACCOUNT three days later, I had no clue how to invest and was always wondering where all my money was going.

As an immigrant navigating a new financial system, I racked up $47,000 in debt. I lived in constant scarcity and stress, convinced I’d never get ahead.

But one day, I decided enough was enough.

I taught myself the skills no one ever told me about—how to manage my money, pay off debt, and build a surplus that allowed me to have a secure future while still doing the things I enjoyed, like splurging on skincare and travelling.

In less than two years, I paid off $47,000 of debt, built a six-month emergency fund and invested $30,000. Using my surplus, I started a business, quit my full-time job, and relocated my parents to Canada. I created a financial system that gave me peace of mind.

Now, I want to help you do the same.

What changed my life wasn’t earning more.

It was building a consistent money routine and religiously allocating my surplus every month toward my goals of paying off debt, saving and investing.

Inside the Surplus Stack Society, I’ll teach you:

|

The exact framework that helped me go from always being in overdraft to more zeros and commas my bank accounts had ever seen. |

|

|

How to make sticking to your goals so effortless, that you look forward to it every month. |

|

|

How to finally take control of your finances and step into your season of abundance, no woo-woo, just a system that works every time. |

introducing

Surplus Stack Society

We bring together accomplished women who are tired of seeing their hard-earned money go to everyone else and are ready to keep more of what they earn. We help you uncover a monthly surplus and allocate it to savings and investments with our Richest Year Roadmap, so you can finish the year with your richest bank balance and the freedom to travel, buy your dream home, enjoy guilt-free splurges, or take a break from work without fear or stress.

Our mission is to help

1,000 women reach $100,000 invested in the stock market

We do this using our 4 main pillars

Action

The biggest roadblock standing between you and your goal is taking action, which is why we design tools that not only help you act but also show you exactly what to do so you are no longer stuck.

Money Promenade

Take the next step without overthinking during our bi-weekly co-working and live coaching sessions.

Valued at $6,000

Challenges

Create momentum and stack quick wins with our monthly short, focused challenges.

Valued at $99

Calling Hour

Take action in less than 5 minutes with our implementation-focused prompts sent 3x/week.

Valued at $99

Surplus Stack System

Turn every paycheque into a simple plan that adds more zeros to your bank balance every month.

Valued at $99

Accountability

We want to make sure you have your richest year, so we check in with you weekly, monthly, and quarterly to see your progress and help you move through any roadblocks.

Richest Year Roadmap

Submit your Richest Year Roadmap each month so we can review your progress together.

Valued at $99

90 Day Action Plan

Create a checklist of three wealth-building activities you would focus on for the next 90 days.

Valued at $99

Money Audit

Receive targeted feedback with one free money audit every month.

Valued at $99

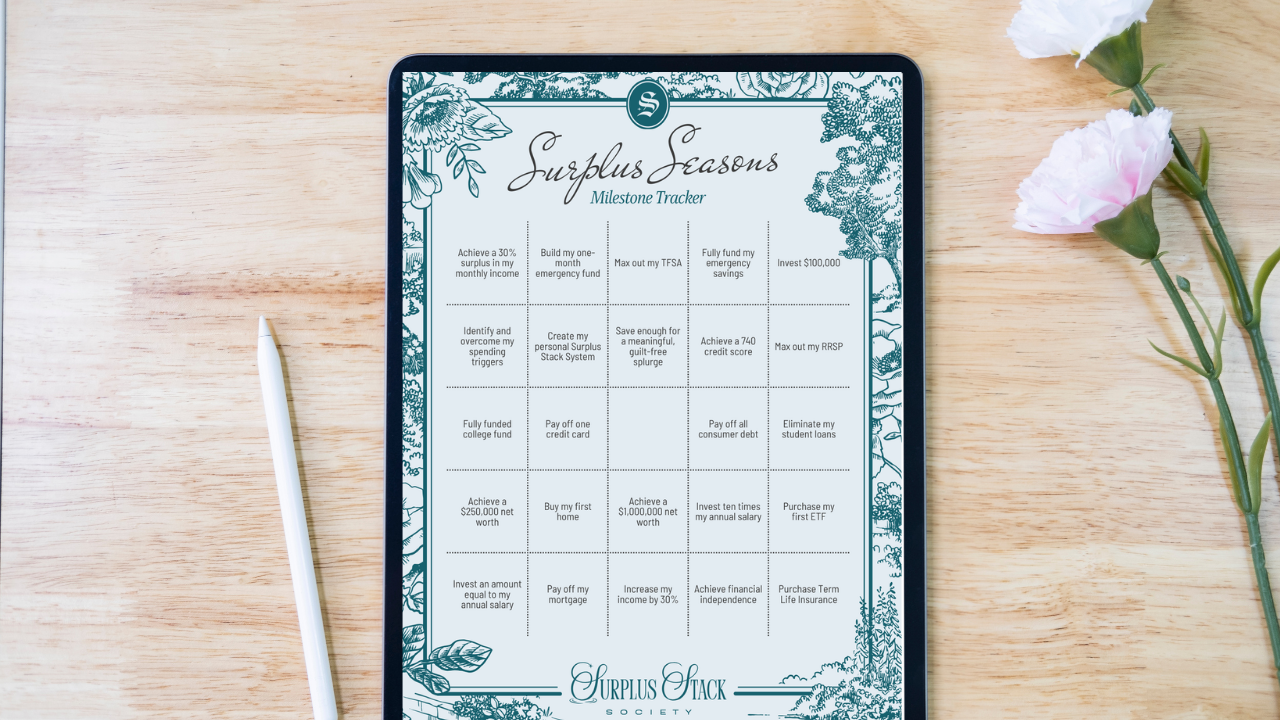

Bingo Card

Stay focused and check off your wins with guided milestones.

Valued at $99

Autonomy

No one should care more about your finances than you, which is why our curriculum gives you the knowledge and clarity to make confident, informed decisions.

The Surplus Method

Make informed, confident decisions by accessing our on-demand course library on mindset, budgeting, debt, saving and investing.

Valued at $2,999

Money Mart

Remove guesswork with our template library to help with everything from negotiating a lower bill to choosing investments.

Valued at $199

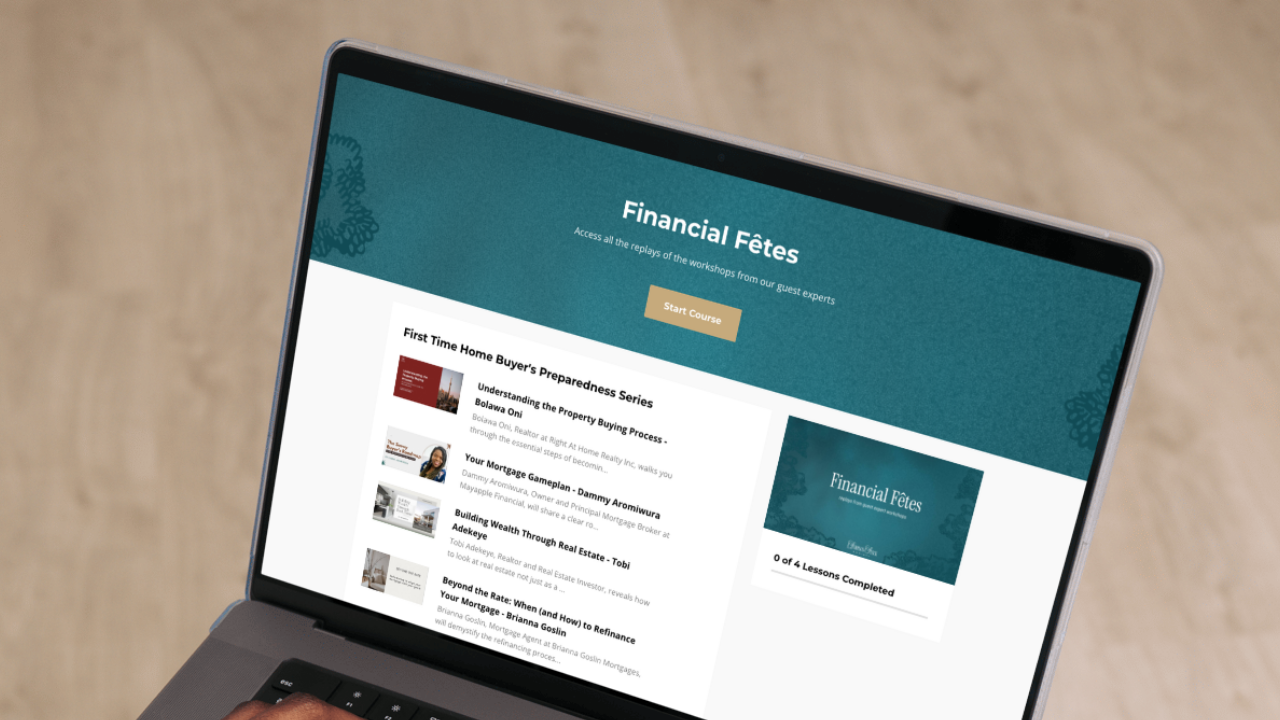

Financial Fêtes

Deepen your knowledge by learning from experts during our live workshops held 2-4 times a month.

Valued at $12,000

Private Podcast

Learn on the go without having to log into your computer.

Valued at $99

Alliance

You do not have to figure out your finances alone, and we go further when we go together. We cultivate genuine community, sisterhood, and support so you feel encouraged and never isolated. Together, we celebrate our wins, share wisdom, and stay committed to making this our richest year yet.

Surplus Circles

Connect with an intimate group of women in your surplus season and get real-time support and accountability.

Valued at $99

Society Houses

Form friendships and meet up in person with other members around your city.

Valued at $199

Summits and Soirées

Receive discounts to in-person events that bring the community together for deeper learning, inspiration, and renewed commitment to your richest year yet.

Valued at $299

That's $23,188 of value

and you can get all of this for less than what you spend on Uber Eats every week.

Your richest year starts now

Choose your plan and get started on your richest year

GST/HST will be added at checkout.

Due to the digital nature of our resources, there will be no refunds. If you are not sure if SSS is right for you, send us an email at [email protected]

- ACTION

- ACCOUNTABILITY

- AUTONOMY

- ALLIANCE

- ACTION

- ACCOUNTABILITY

- AUTONOMY

- ALLIANCE

- ACTION

- ACCOUNTABILITY

- AUTONOMY

- ALLIANCE

- ACTION

- ACCOUNTABILITY

- AUTONOMY

- ALLIANCE

The SURPLUS Method:

Your roadmap to abundance

Our program is built around the SURPLUS Method, designed to guide you step-by-step through your financial journey, no matter where you’re starting:

| S |

Strengthen your surplus mindset:Ditch limiting beliefs that are causing you to play small and live in scarcity and shift to empowering beliefs that allow abundance to flow effortlessly and unleash your Big Surplus Energy. |

| U |

Uncover 30% surplus cash flow:Free up 30% of your income for saving, investing, and financial goals. |

| R |

Reach 3 months in surplus savings:Build an emergency fund that can cover at least three months of your living expenses. |

| P |

Pay off all consumer debt:Pay off all your consumer debt and free up more cash for things that actually matter the most. |

| L |

Land a surplus of your annual salary in investments:Build a surplus of one year's salary in investments to achieve financial stability and security. |

| U |

Utilize your surplus for your kid’s future:Invest in your children’s financial security through education investment accounts, trusts and term life insurance. |

| S |

Secure your financial independence:Achieve financial independence, where investments support your lifestyle and work becomes optional. |

Turn your surplus into stacks of zeros and commas using the SURPLUS method

A step-by-step framework to take you from financial stress to financial overflow, whether you're starting from scratch or simply need the accountability to stay consistent.

Each season allows you to focus on 1-2 goals at a time to help you see faster progress and avoid overwhelm.

The

Debutante’s

season

Strengthen your money mindset and uncover your 30% surplus in your disposable income.

The

Baroness’

season

Build a three-month emergency fund and pay off all consumer debt.

The

Viscountess’

season

Grow your investments to $100,000 or one year of your annual income.

The

Duchess’

season

Grow your investments to 10X your annual income and achieve financial independence

Hear from Society’s Diamonds

This Debutante’s Triumph

Ordia went from falling behind on bills and relying on her line of credit to make rent to building a surplus that allowed her to pay off credit cards, handle a tire emergency, and confidently switch jobs.

This Baroness’s Breakthrough

Olivia was stuck in a debt cycle and couldn’t see a way out. With an effective money system, she was able to pay off her debt, build savings, and start investing, allowing her to take a guilt-free maternity leave.

This Viscountess’ Victory

Petra was terrified of investing, so she left a sizable amount of cash sitting in her account, doing nothing. After building an investment plan together, she confidently invested her money, which grew by over 50% in just 1.5 years.

Are you ready to make your debut?

By joining the Surplus Stack Society, you will:

|

Achieve a 30% surplus in your monthly disposable income within the first 30 days. |

|

|

Build an emergency fund of at least three months’ expenses to safeguard against the unexpected. |

|

|

Pay off consumer debt and free up income to focus on your goals. |

|

|

Learn how to grow investments to match 1x to 10x your annual income, setting you up for long-term security. |

|

|

Step into financial independence, where work becomes optional, and your legacy is secure. |

and finish the year with more zeros and commas in your bank accounts than ever before.

don't wait another second to get richer

Every month you stay inside the community, you get richer!

Turn your dreams of getting rich into reality

Choose your plan and get started on your richest year

If all you could do this year was add one more zero to your bank balance, would it be worth it?

ON THE FENCE ABOUT JOINING?

Is the surplus stack society right for you?

The Surplus Stack Society is for go-getters who want to live a rich life and who are ready to set audacious financial goals, build a realistic plan that actually works, and stay consistent until those goals become reality.

We’ll give you the knowledge, templates, resources, support, and accountability to help you get there, and all you have to do is show up.

And honestly, the SSS is so packed with value that even if all you do is create your Richest Year Roadmap, check off one action item on your 90-Day action plan, receive one tailored money audit, only attend one group coaching call, listen to one private podcast episode, complete one challenge, or join one workshop, you’ll get more than your money’s worth.

THIS IS FOR YOU IF:

You're making money every month - but don't feel in control of where it goes or how it supports your future

You have a goal to pay off debt, save, invest or reach financial independence but don't want to sacrifice tacos on tuesdays or spa days to get there

You need guidance and/or accountability to help you stay consistent so you can achieve your financial goals

this might not be for you if:

You are currently underearning and don't have any disposable income

You would rather work with a financial advisor that does all the work for you

You aren't a key decision-maker in your household finances

Ready to get richer?

When you join the Surplus Stack Society, you will...

Achieve a 30% surplus in your monthly disposable income within the first 30 days.

Create a money system where every dollar you earn has a job and runs on autopilot

Build an emergency fund of at least three months’ expenses to safeguard against the unexpected.

Pay off consumer debt and free up income to focus on your goals.

Learn how to grow investments to match 1x to 10x your annual income, setting you up for long-term security.

Step into financial independence, where work becomes optional, and your legacy is secure.

Your whole life could change in one year

Your financial transformation starts here.

Step into the Surplus Stack Society, and in just 30 days, you’ll start creating a surplus that allows you to save, invest, and live abundantly on your terms.

Your season of getting richer starts now.

I'M READY TO CHANGE MY LIFEGot questions?

I have answers

I don’t have much income, CAN I STILL HAVE A 30% SURPLUS

Honestly, if you're barely making ends meet, then this program isn't for you. But if you can typically cover all your essentials, but you can't maintain a surplus due to unplanned expenses, we will help you build a money system to help you clearly see where you money is leaking, plug those leaks and keep more of your surplus.

I'm not sure I can attend the calls. would this still benefit me?

All of our live sessions are recorded, and the replay is made available within minutes. And honestly, you don't even need to attend the live calls to see results because the course is designed to help you implement without confusion, our templates show you exactly what to do, so you don't even have to ask, and if you're ever stuck, you can ask questions in the community or send me a private message in the community and get quick answers.

How long does it take to see results?

The first thing you do when you join SSS is to fill out your Surplus Stack System and 12-month Richest Year Roadmap, which will help you clearly see how much richer you can get this year. So you could see results from day one.

What if I don’t have time?

I get it, life can get hectic, which is why our Surplus Stack System is designed to help your money run on autopilot, so that even if all you have is 20 minutes per month to check in, you will still be on track to reach your richest year yet.

Is this for me if I already have investments?

Yes! Many members who join SSS already have investments, but they aren't confident in their choices. We help you map out what your first $100,000 invested in the stock market should look like and the exact types of investments you should hold at each stage from your first $1,000 to your next $25,000, until you hit $100,000 invested.

Can I CANCEL MY MEMBERSHIP?

Yes! You can cancel your membership at any time inside your members' area; you don't even need to send an email.

So what are you still waiting for?

Choose your plan and get started on your richest year

Step into your richest year yet

Unlike other subscriptions that make you spend more, the Surplus Stack Society is the only subscription you will ever have that ensures your bank balance grows every month.

Start Your Rich Year Now.

I'M IN!